Ethereum 2.0, understanding the concept of "The Merge

After many months of waiting, The Merge, the first step towards Ethereum 2.0 is finally here.

The Merge is the fusion between two concepts aiming to improve and optimize the functioning of one of the biggest crypto platforms.

The Merge, also known as Ethereum 2.0, is a major upgrade to the Ethereum blockchain that aims to move from Proof of Work to Proof of Stake for transaction validation.

This upgrade is expected to bring several important improvements, including increased speed and efficiency of the Ethereum network, as well as reduced energy consumption.

So let's take a closer look at this concept and how it works. We will also look at the possible consequences over time, especially on the price of Ether.

Understanding the new Ethereum 2.0 (Eth2)

The Merge has a nice ring to it and is the name chosen for a major update to the Ethereum platform. Ethereum 2.0 is a project that has been delayed several times.

Why the idea of an Ethereum 2.0?

Ethereum is a platform that has revolutionised the crypto world. That is a fact. Except that its engine or consensus is reaching saturation.

Indeed, in 2015, Ethereum's incredible journey began with the Proof of Work (PoW). While this method of validating blocks proved its worth, limits very quickly became apparent. However, the platform preferred to push back the deadline before taking a new step.

The limits of Ethereum's Proof of Work

PoW is based on mining technology and allows transactions on the blockchain to be validated.

It uses network nodes to evaluate exchanges that are then added to a block.

This system does work, but it requires a major set-up that is both costly and energy-intensive.

In addition to the problem of high energy consumption, PoW is not necessarily compatible, in the long term, with the scalability of blockchains.

In this case, the issuance of tokens on the blockchain is limited and depends on the rewards given to miners.

Proof of Stake for Ethereum 2.0

In Ethereum, a faster, more robust and more energy-efficient consensus was expected. The Proof of Stake (PoS) option seemed logical.

With this PoS method, the energy consumption is lower. In this case, it is not computers that perform the validation, but the stakers. Each of them can become a validator.

.

Comments: Some critics point to the "real" changes brought about by the PoS. In particular, the reduction of transaction fees and the speed of transactions. In any case, it has taken time, but the foundations for an Ethereum 2.0 are now in place.

Buy your first crypto in euro with Galeon

Implementing Ethereum 2.0 with The Merge

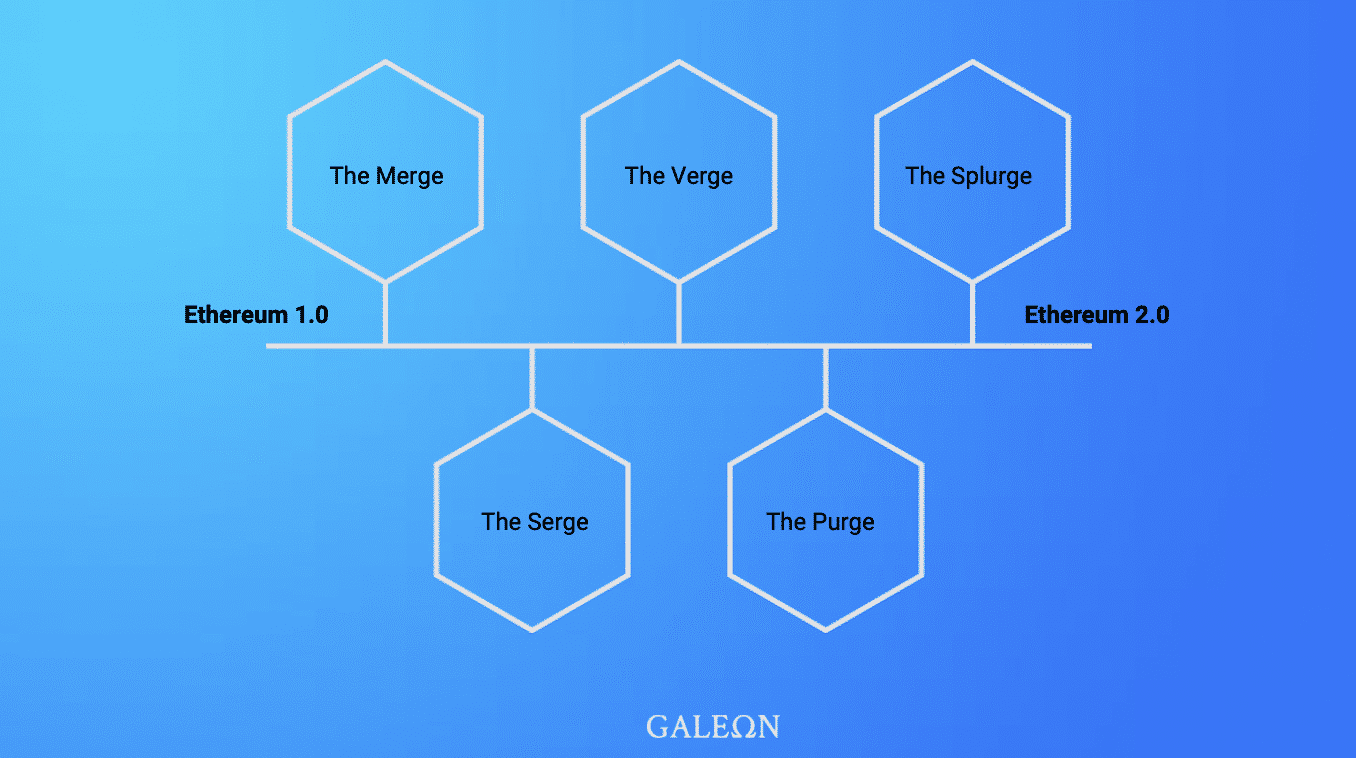

It is perhaps worth pointing out that The Merge is really only part of the process of updating the Ethereum platform. More will come later.

Technically, The Merge defines this merger between the main platform, Ethereum, and Beacon Chain, an ancillary platform to Ethereum.

The primary objective of this step is to achieve a faster, more decentralised and more robust consensus.

Beacon Chain, an Ethereum side platform

This blockchain was launched at the end of 2020 with a dual mission:

- Coordinate and manage a network running on PoS,

- Coordinate it with the "Shards" (sub-networks of Ethereum).

So where does Beacon Chain stand since then? For the moment, Ethereum has only created the platform.

Its role is to pass all the blocks from the main Ethereum blockchain under the scanner of the PoS, thanks to Beacon Chain. In short, it would take over its transactions. Thus, it would allow to add both new validators and to stake more ETH (+1 for decentralisation).

More validators thanks to Ethereum 2.0

The numbers speak for themselves: in 2020, there were almost 30,000 validators on Ethereum compared to 411,000 on Beacon Chain (+1500%).

What is the point of becoming a validator on Beacon Chain? Once the execution of the protocol is launched, a Beacon validator will instantly become a validator on the Ethereum network.

Expected consequences for Ethereum and the ETH price

A less energy consuming consensus

As we mentioned at the beginning, one of the reasons for this change comes first of all from the concern of energy expenditure. It is known that PoS is capable of reducing consumption by 99.95% compared to PoW. In other words, with Ethereum, the consumption will be less than 0.05%.

Improving the scalability of ETH

It's been a while, but we can't ignore the fact that the Ethereum platform is reaching saturation, its ETH token issuance is limited.

With Ethereum 2.0 and this parallel Beacon Chain platform, miners will no longer exist, nor will the reward system.

How will this revolutionise the token economy?

With miners, the entire issuance system depended on the rewards they received:

- 4.930 million ETH were distributed each year, increasing the inflation rate to 4.13%,

- + 540,000 new tokens allocated per year to validators on Beacon Chain (inflation of 0.49%)

With The Merge, the mining system and with it, the miners, will be removed. The 0.49% of validators on the Beacon Chain will then be retained.

Note that in addition to this set-up, there is the possibility of burning tokens every day since a recent update (EIP 1559). So, this brings the rate down.

Now, can we say that all this will influence the value of the ETH price? If the inflation rate reaches almost 0, then we can talk about deflation. However, if the level of supply and demand increases further, the value will follow suit.

And after The Merge?

Finally, The Merge is participating in this transformation of Ethereum into version 2.0. But as we said before, it is only one step among many.

After the merger with Beacon Chain, the founders estimate that the state of progress will be about 50%, with a final stage by 2028/2030. There is plenty to do in the meantime.

The purpose of this article is above all to simplify technical concepts related to crypto-currency, in order to make them accessible to all. These words therefore only commit their author. It is not intended to advise the reader on his investments.

Want to buy your first cryptocurrency easily?

Invest in the Galeon crypto by credit card

ext here...