Crypto bridges and DeFi: the challenges for the next few years

Crypto bridges are computer protocols allowing communication between different blockchain networks.

The idea is to facilitate exchanges between digital assets with the limitation of transaction costs, faster transfers...etc.

The advantages are multiple for the decentralized finance (DeFi), certainly, but risks exist.

Indeed, if the benefits for DeFi (Decentralized Finance) are obvious, there are still important security issues.

Just take the example of the Nomad Bridge which recently suffered a hijacking of more than 190 million euros.

Before addressing the risks, let's ask ourselves several questions: How are crypto bridges useful for DeFi? How do they improve interoperability between blockchains and what are the different types?

Thanks to crypto bridge technology, blockchain networks have room to grow.

Imagine a bit the concept like islands connected to each other.

This makes it an interesting option for DeFi projects.

Nevertheless, the security risks are real. The transparency and free access to these open-source projects increase the threat of hacking on the networks.

To understand the use and operation of these crypto bridges, let's first go back to the basics of DeFi.

PART 1: DeFi, a new type of decentralised organisation

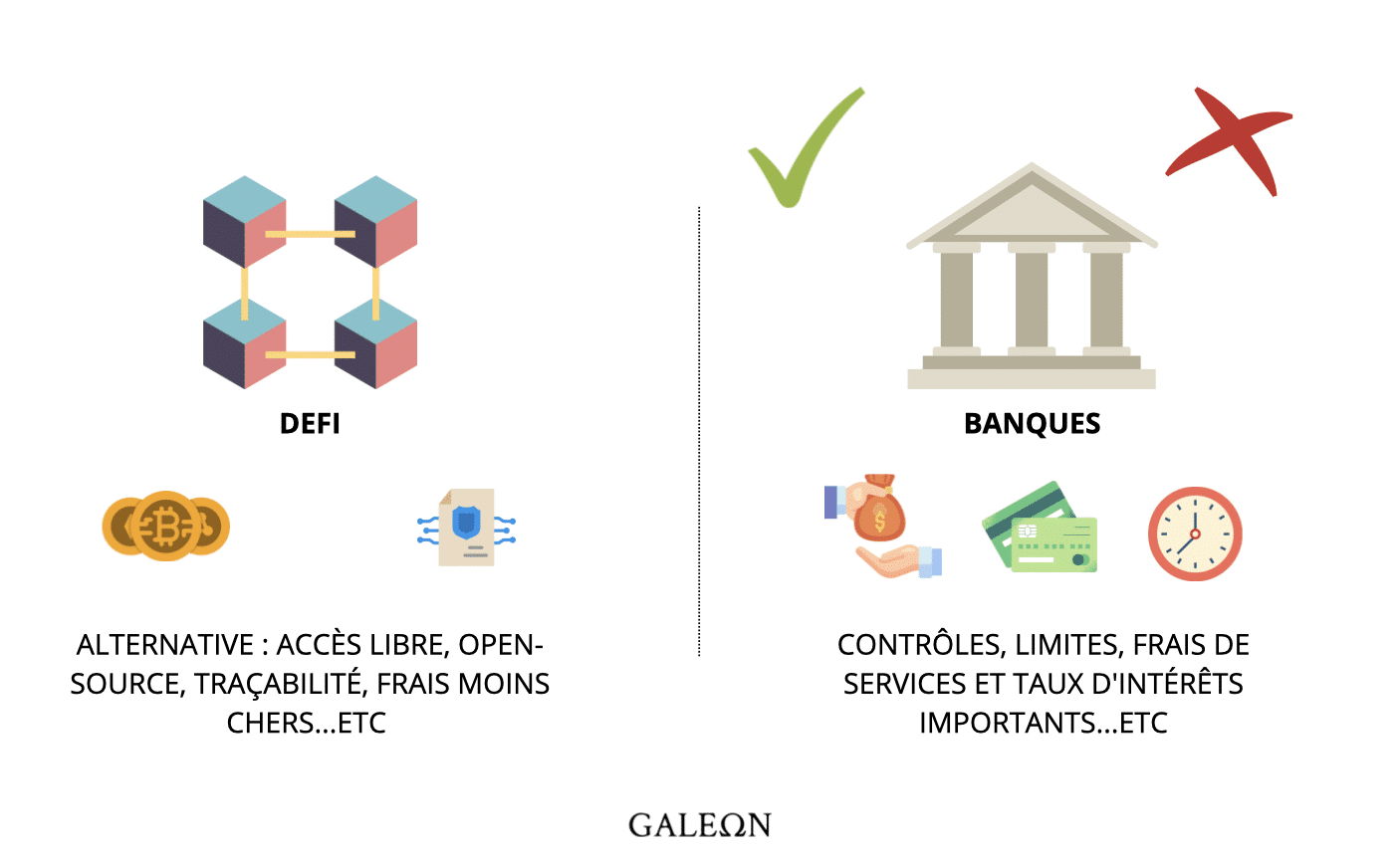

DeFi comes from the shortened term Decentralized Finance.

It represents those communities providing different financial services that globally revolve around crypto-currency and smart contracts.

In concrete terms, DeFi projects use "decentralized" protocols to develop various services such as platforms for lending or sending crypto around the world; for P2P transactions or for making savings; or in order to make purchases of shares and other digital assets.

Ordinary financial services, after all, without the involvement of banks or institutions. Otherwise, one will not go through an intermediary, a guarantor or a broker.

It is therefore easy to understand why a number of DeFI projects have been flourishing in the market in recent months.

What DeFi is providing?

First and foremost, it is the idea of ensuring the transparency of exchanges and transactions.

Everyone has access to the open-source code present in smart contracts. Note that users retain ownership and management of their crypto through the allocation of private keys.

With DeFi, we also want to strengthen financial inclusion. That is, to ensure that every user can have access to the same functionalities according to their needs, at a lower cost and no matter where they are.

Examples of projects? Uniswap to facilitate exchanges; Terra Luna also, with instant transfers; Aave, whose principle is to allow the lending of crypto-currencies.

Buy your first crypto with Galeon

PART 2: crypto bridges, useful tools for DeFi

Crypto bridges offer solutions to certain problems such as scalability.

Definition

Crypto bridges create connections between the networks of different blockchains. They take the form of a computer protocol that establish A-B communications or from point A to multiple points.

Are crypto bridges necessary?

Not necessarily necessary, but crypto bridges are in any case very useful and in line with the objectives of DeFi: to strengthen the interoperability of networks, access to services and the scalability of blockchains.

Interoperability between networks

For example, installing a crypto bridge within multiple networks improves interoperability between blockchains. If there are more touchpoints, it extends connections and diversity of services.

Accessibility and financial inclusion

In addition to the interoperability between blockchains, users can also perform more operations, faster and with less transaction costs compared to the centralised system.

Scalability of blockchains

Finally, there remains the subject of scalability*, which is a bit more debatable.

*It is the capacity of a blockchain to adapt its protocol in order to increase the number of transactions per second, and this, without impacting or slowing down the price.

With bridges, the capacity to validate transactions is increased by multiplying the number of validators.

? Note: a general criticism raises the question of the real usefulness of crypto bridges and the risks that this entails for network security. Establishing connections, yes, but one must be careful about the flaws that could exist in an underlying layer of a protocol. An attack not parried at this level will affect the linked blockchains

How crypto bridges work

Let's say you are an Ethereum user and you want to use your tokens to benefit from the services of the Solend platform, an investment and borrowing platform present on Solana.

To do so, you will need a connection tool between the two platforms and an equivalence between ETH and SLND tokens. This is where the bridge comes in.

At the entrance of this bridge, the transaction conditions are established according to the code dictated within the protocol (see below).

Distinction: centralized / decentralized bridges

The technology used can take two forms.

- Centralized (trust-based) bridge: the processing of information is handed over to a centralized entity. The exchange is faster and, above all, more important (e.g. OKex).

- With decentralized bridges ("trustless"), algorithms from smart contracts will take over. (thus without intermediary, ex: Multichain). Validators will be rewarded only once they have completed their mission of validating transactions from the starting point to the end point.

? Note: How do we ensure that operations are not biased? This is the whole issue of decentralization and the validation system.

Structure: the different connections established by bridges

A bridge, depending on its protocol, can link different types of blockchain networks together. We also talk about layers or *layers.

*Layers are the layers of networks that level the blockchains. Depending on the constitution and the state of progress of the blockchain, several levels could be established (from 0 to 4 in principle).

Like the base of a pyramid, layer 0 is the most important one because it maintains the foundations. If this layer is wobbly, it does not ensure anything good for the upper layers.

Note that the reverse is not necessarily true. The upper layers can fail without affecting the functioning of the first layer.

Some Type 1 Layers are completely independent and can function on their own (e.g. Bitcoin or Ethereum). They can validate and finalize transactions without having to call on a higher layer.

The purpose of Type 2 Layers is to bring improvements to networks, especially in terms of scalability.

With that aside, let's get back to the structure of a bridge and its protocol. Depending on what has been established, the connection can link :

- 2 Layers de type 1,

- 1 Layer de type 1 avec un de type 2,

- 2 Layers de type 2.

The different possible operations

As mentioned earlier, the bridge protocol determines the conditions under which the connection between the different networks will be carried out. Let us not forget that a validation test is necessary to validate the transaction.

A protocol can therefore decide to proceed in different ways:

- it can "lock-mint" -> first lock the tokens on the first network, then produce the equivalent number on the second.

- "burn-and-mint" -> burn the tokens on network 1 to create new ones on the second chain.

- and "swap" -> exchange two different crypto-currencies with smart contracts.

PART 3: Safety Risks

Just like in the real world, the structure of a bridge is never 100% foolproof. And crypto bridges are no exception to the rule.

One of the current issues is therefore how to consolidate this tool to optimize the DeFi without impacting security.

Examples of hacking

1/ In March 2022, Ronin crypto-currency network used by gaming platform Axie Infinity, gets its bridge hacked. ETH and USDC were hijacked for a total amount of more than 600 million dollars.

2/ In August 2022, it was around the Nomad bridge allowing the interconnection between several blockchains to have its protocol siphoned. The bridge seemed to register arbitrary amounts in phase 2 of the protocol. In total: 190 million euros were hacked.

Interdependence and snowball effect

The consequences on the interoperability between several blockchains can be heavy and the transactions lose their value. Of course, some platforms, including the best known like Ethereum, have more guarantees than others.

Any solutions planned?

Since the fragility of these crypto bridges is mostly based on their protocol, and especially, on their lack of consideration towards security, why not find a solution at the source?

We talked about the layer 0 before. So, why not the Layer 0? In any case, this is a solution proposed by some specialists.

? The idea is quite feasible. Rather than answering the problem of network scalability by the automatic construction of a crypto bridge, why not consolidate upstream, the foundations to facilitate future operations?

Bridges are necessary and useful tools, certainly, but it is necessary to be able to ensure for the sake of DeFi that the protocol will hold in case of an attack, and that the foundations will not collapse at the slightest offensive.

The purpose of this article is above all to simplify technical concepts related to crypto-currency, in order to make them accessible to everyone. These words engage only their author. It is not intended to advise the reader on his investments.

Want to buy your 1st crypto easily?

Invest on the Galeon crypto by credit card